One way or another, local taxpayers will feel the pain of 2017 county budget

There seems to be no path county legislators can go down with the 2017 county budget that doesn't hurt taxpayers.

Nobody wants to see a tax increase, especially one that is higher than the state-mandated tax cap, but that's exactly what is under consideration by the nine-member body.

Legislators must also decide whether to spend tomorrow's money today or make drastic cuts in personnel that will leave taxpayers with curtailed essential services.

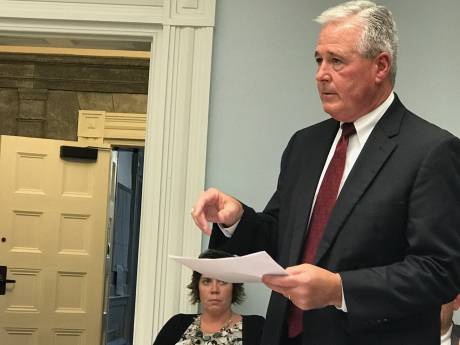

The hard choices discussed at a meeting Wednesday night left everybody a bit frustrated, Chairman Ray Cianfrini most of all, who said if the legislators can't reach a consensus and pass a budget by Dec. 14, the county will be left, by law, with the budget proposal originally drafted by County Manager Jay Gsell.

"If we're not careful, the budget we get will be Jay's budget, which is the budget we all like the least," Cianfrini said.

That budget doesn't raise taxes -- though it does increase the tax levy above the state-mandated level -- but it grabs two big buckets of money the county will need in future years and spends it in 2017.

Gsell's budget is balanced because it takes $1 million in sales tax revenue that would normally be rolled over into funding for future capital projects, such as roads and bridges, and it draws down the county's reserve funds by yet another $1 million.

The tax rate for local property owners would be $$9.76 per thousand of assessed value, which is slightly lower than 2016 rate, but because of an increase in assessed value for county properties, would actually raise more money.

Because of the state's tax-cap formula, which adjusts the cap based on changes to assessed value, the county can't approve a rate above $9.86 without overriding the tax cap.

That's something the legislators seem willing to do under the circumstances.

None of them like the idea of diverting sales tax revenue away from roads and bridges (and the likelihood the county will be forced to build a new jail within the next five years), so that proposal is no longer under consideration.

But legislators can't agree on whether to tap into reserve funds to balance the budget. There's no more than four votes for that option, even if the amount taken from reserves is reduced to $500,000.

"I'm much more concerned about what's going to happen long term," said Legislator Bob Bausch. "I'm not willing to have my kids and my grandkids paying our bills."

Legislator Andrew Young was adamant that the Legislature needs a plan to ensure the county's financial viability before he could agree to spend any more reserves.

"We're working on deficit budgets and eventually that's going to catch up with us." Young said. "We need to put a pencil to this budget and cut things."

Young noted that Treasurer Scott German has warned that if the county continues to spend down reserves, it's looking at insolvency within five years.

To that end, Young was ready to push for the Legislature to eliminate the two corrections officer positions requested by the Sheriff's Office, but also leave unfilled a road patrol vacancy that will open up at the beginning of the year.

That would save the county about $200,000 in 2017.

Cianfrini said if that was part of the final budget, he would have to vote no. The Legislature was split on whether to then eliminate just the two CO positions or just the deputy position.

The reason the Sheriff requested the CO positions is those new hires could start handling prisoner transports for female prisoners between Genesee County's courts and the county jails where they are housed (because Genesee County's jail can't house female prisoners). The county is facing rapidly rising overtime costs because of the transports and road patrol shifts are sometimes short of manpower.

Bausch and Legislator John Deleo were both opposed to any significant tax increase, especially the nearly $1 million increase needed to make up for not spending reserves and not diverting sales tax revenue.

Even when asked to consider spending only $500,000 of reserves, Deleo looked at the potential tax rate, shook his head and muttered, "that's just too much."

He said he was concerned about the burden on taxpayers in the city.

"People tell me all the time to hold the tax cap," Deleo said. "They stop me in the street. But even if we hold it to the 2016 rate, we can't make this work. It's just unreal."

Bausch said there is another constituency to seriously consider -- farmers, who own most of the land in the county.

"Even a 10-cent increase would have a big negative impact on our farmers and they're the number one industry in the county," Bausch said.

There will be some budget relief once the county closes on its deal to sell the County Nursing Home, but the impact will mostly be a one-time benefit and not help the longer term, growing fiscal crisis facing the county.

The legislature meets again on Monday evening to take up the budget discussion once again and see if they can come to an agreement on taxes and spending for 2017.

The total proposed buget for 2017 is $146,249,625, which includes all expenses covered by all funding sources, including revenue received from various other funding sources besides property and sales tax. A property tax of $9.76 per thousand would raise $27,844,499 (the tax levy). The county is also budgeting for about $18 million in sales tax revenue. A large proportion of the county's expenditures are mandated by state law and can't be eliminated.