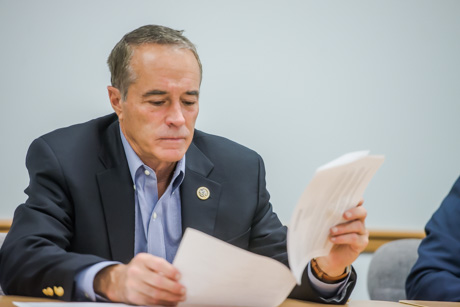

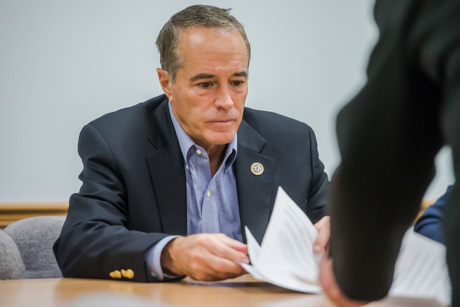

It's not technically accurate to say the House Ethics Committee is investigating his involvement with Innate Immunotherapeutics, Rep. Chris Collins said today while in Batavia.

There have been questions about Collins and his alleged "insider trading" related to the Australia-based pharmaceutical company for more than a year.

The issue was first raised, Collins said, by Rep. Louis Slaughter, which led to an investigation by the Office of Congressional Ethics.

The three charges investigated by OSCE were dropped but the investigators referred two additional points of inquiry to the House Ethics Committee.

That, Collins said, is not an investigation.

"The Ethics Committee hasn't done anything," Collins said. "So to people who say I'm being investigated by ethics, I would say ethics is reviewing the OSCE, what I call 'the mall cops' report.' That doesn't mean they're investigating. And what didn't they do -- they did not appoint a subcommittee to look into it. If they thought there was wrongdoing they would have appointed a subcommittee to look into this."

Collins called the initial three points of contention and the two new issues a "nothing burger."

The points initially raised by Slaughter, he said, were that he had insider information about the progress of a clinical trial that he shared, that he facilitated discounted stock trading for congressional members, and that he supported a bill, the 21st Century Cures Act, because it benefited Innate.

To the first charge, Collins said, the clinical trial was a double-blind trial with nobody at Innate, including him, getting any idea of the potential results until the trial was completed and the results were released in July.

He couldn't have provided information on the trial to anybody because there was no information to provide.

As to the alleged illegal discount, Collins said, "We got this discount. The Office of Congressional Ethics totally dismissed that because it was available to every investor."

The allegation that Innate might someday come to the United States, and therefore benefit from the 21st Century Cures Act, was so preposterous, Collins said, that OSCE dismissed it without giving it serious consideration.

"That was such an outlandish allegation it wasn't even investigated," he said.

Out of the all the documents and emails reviewed by the OSCE, the staff came up with two more items it referred to the House Ethics Committee. One was that Collins allegedly communicated non-public information in emails to other investors and that he provided insider information about Innate to staff at the National Institute of Health.

In emails, Collins said he mentioned that the clinical trial had 93 participants. It was public knowledge that the trial would have at least 90 participants and the fact that there was 93 wasn't material to the value of the stock, he said.

He also shared his personal view that the trial would be done by a certain date, and then another date after that, and then a date after that, and in all cases he was wrong, he said.

"It was just my personal subjective opinion," he said.

'"Our CEO has done an affidavit saying he looked at those emails and there was nothing non-public in them," Collins said. "There was nothing significant in them."

As for the number of participants, he said, it's standard practice to sign up more participants than needed for a trial because some patients always drop out. The count of 93 vs. 90 really meant nothing to the value of the trial and it wasn't considered a secret by the company.

"Anyone who had called our office and asked how many people were recruited, we would not have even considered that confidential information and would have shared it," Collins said.

Significantly, Collins said, none of the people whom Collins shared information with through the emails bought or sold shares after receiving the information.

"If no one traded on it, even if I did share nonpublic information, there's no crime," Collins said.

The NIH meeting, Collins said, was part of a two-hour tour of the facility that he initially forgot about when the issue came up again a couple of years later.

The so-called insider information provided by Collins was an introduction of one scientist to another. It's common practice, Collins said, for NIH scientists to share information with outside scientists.

"There was a scientist in the one meeting who was looking at biomarkers and other indications from multiple sclerosis, a debilitating disease, and some things (some aspects of the research) that there are no hard science measures on," Collins said. "It looks like this. It looks like that. Boom. Boom. Boom Boom Boom.

"And I said, 'you know, you might want to talk to our scientists because we're finding the same frustration in finding scientific measures of secondary progressive M.S. because there aren't any -- it's quality of life, patient-reported outcomes, doctor-observed things that are subjective, not objective, not scientific.

" 'You might want to want to talk to Jill. You guys should share some information.' And this woman said, 'I think it makes a lot of sense,' because that's what they do with the NIH. They talk to companies all the time."

The OSCE didn't even give Collins a chance to respond before forwarding the issue to the ethics committee, he said.

"My attorneys have subsequently done that, to point out that part of the role of the NIH is to meet with outside scientists," Collins said.

Now that these issues are in the hands' of the ethics committee staff, there isn't much Collins can do but sit and wait, he said.

It's possible there will be an investigation, but Collins said he knows of members of Congress who have waited for years while the committee did nothing on complaints brought to them, and didn't even publicly acknowledge when the case was dropped.

"Here's the most frustrating part," Collins said, "they may never look at this. This could be hanging over my head as a 'nothing burger' because they're not even investigating it."