One way or another, the Town of Le Roy is not expecting to spend $40,000 in 2019 to support Le Roy Ambulance, according to Supervisor Steve Barbeau.

Barbeau presented his tentative 2019 budget to the town council at Thursday's meeting and then discussed the future of the Le Roy Ambulance after the meeting.

Barbeau said based on his discussion with representatives of the ambulance service, Le Roy Ambulance has reached a point financially where it either needs the tax support of a special district or the nonprofit corporation must be dissolved.

If the proposed budget doesn't change before approved, Le Roy residents would find their town property tax rate reduced by a nickel, from 90 cents to 85. The total levy would be $206,248.

In all, Le Roy, excluding special districts, will need $1,427,441 to operate in 2019.

The proposed budget includes raises for non-union staff of varying amounts depending on which department the staff serves.

Town board members will be able to start going through more detail at its Sept. 27 meeting.

Some adjustments may be necessary because since Barbeau prepared the tentative budget, he's received new information, including a reduction in workers' compensation insurance costs, a reduction in STOP-DWI money transferred from the state to the town's justice department, and a $5,000 expense for the town to work with the county on a records archive project.

Ambulance Service

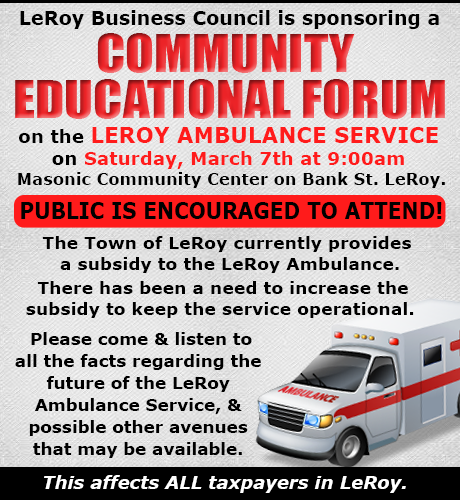

As for the ambulance service, a public meeting planned for next week has been canceled because the attorney for the ambulance service has had some health issues. It hasn't been rescheduled yet but the attorneys are working on finding a new date.

At the meeting, the public will learn about the options for the ambulance service and about the prospect of setting up a special district.

After that meeting takes place, Barbeau would like to conduct a straw poll of residents. It would be a non-binding vote held at the Town Hall. Like a school budget election, all residents at least 18 years old would be eligible to cast votes.

The results, Barbeau said, could help the Town and the Village decide whether to support a special district for the ambulance service. If the vote was lopsided one way or another, officials could gauge whether voters would likely support a special district. A close vote would make the difficult decision even more difficult, Barbeau acknowledged.

Either the Town or the Village could approve the formation of a special district without a voter referendum. Residents could challenge any decision by either jurisdiction through a petition (100 signatures required) for a public referendum to overturn the decision.

In other words, if the Town board voted against the formation of a special district, through a petition drive, the decision could be challenged by voters. Or if the board agreed to form a district, that decision could be challenged as well.

The same goes for the Village.

Barbeau speculated that if only the Town supported a special district and the Village didn't, it wouldn't be financially feasible for the ambulance service to continue; however, the district could successfully form if approved by the Village but not the town.

Even with the $40,000 from the Town, Le Roy Ambulance has been losing money, Barbeau said. It's his understanding that a big issue for the service is patients' failure to pay their bills. He said last year, Le Roy Ambulance had $75,000 in uncollected fees.

A lot of people, Barbeau said, get their insurance check after an ambulance ride and instead of paying their ambulance bill say, "oh, Christmas in July" and pocket the money.

"I think by November of this year a decision needs to be made (about the future of the ambulance service)," Barbeau said, "because the $40,000 is not going to be in the budget for the ambulance. Imagine what their deficits are going to be without it. So they're either going to have to start taxing in 2019 or start exhausting the assets that they do have."

There is a complex process to wind down a nonprofit, Barbeau said, so without a special district, Le Roy Ambulance would begin that process in 2019 until it discontinued service.

Barbeau is seeking clarification from Mercy EMS on what level of service it will provide Le Roy if Le Roy Ambulance closes. Right now, there is an agreement that ensures Mercy EMS is the backup service for the Town and Village.

If Le Roy Ambulance closes, Mercy EMS would by default become the primary ambulance service at no cost to the Town of Village.

Previously, Mercy officials have indicated they would consider making Le Roy their base of operations for the eastern part of the county if Le Roy Ambulance shut down. Barbeau would like to confirm that suggestion.

"The issue has always been, for the town board -- response time," Barbeau said. "Le Roy Ambulance has a response time that averages less than five minutes. If they're out on a call, Mercy comes from Batavia. They have a response time that's just shy of 20 minutes, and that comes from years' worth of data. So the rationale behind our subsidy has been to keep that response time for folks knowing we still have Mercy as a backup."

Barbeau praised both services. He's had experience with both. Ambulances were called twice to his late father's house. In the first instance, Le Roy took three minutes to respond. In the second, Le Roy wasn't available and Mercy EMS responded from Batavia, which took 18 minutes.

In that case, he said, it wasn't life or death but for a person suffering a heart attack or stroke, those 15 minutes could be critical.

County Sales Tax

During the meeting Thursday, Barbeau also discussed his understanding of a new proposal from the County on how to divvy up the local share of sale tax revenue.

Before getting into what Barbeau said, some background:

Currently, local consumers pay 8 percent sales tax on qualifying purchases. The state takes 4 percent and 4 percent is supposed to stay in Genesee County.

The county could keep that 4 percent to itself but has traditionally shared the revenue with the other municipalities in the county. If the County didn't share with the City, the City of Batavia could institute its own sales tax. The villages and towns don't have that option.

Under the current formula, the County keeps half of the local 4-percent share, or 2 percent of the sales tax. The City gets 16 percent. The remaining 34 percent is divided among the towns and villages, using a formula derived from the assessed value of properties in each jurisdiction.

It's Barbeau's understanding based on his conversations with other officials, including County Manager Jay Gsell, that the County and City are set to enter into a new agreement that would keep the City's share in the 16 percent range, but that amount could fluctuate depending on the amount of sales tax revenue flowing into the county. It would never be less than 14 percent and the City couldn't receive more than a 2-percent share of anything over the prior year's amount of sales tax.

The villages and towns are not included in the agreement. Instead, they would each be asked to sign identical revenue distribution agreements.

All of the agreements would last for 40 years.

For the villages and towns, their share of sales tax revenue would be capped at the absolute dollar amount of 2018, but their share could go down if sales tax revenue goes down.

There would be no adjustments for inflation.

Barbeau said it's his understanding of the county's perspective on the agreement is based on three factors:

- The county is facing a state mandate to build a new, expensive jail. The bond on that jail will take 40 years to pay off.

- The new "Raise the Age" law, which mandates new rules for criminal cases involving 16- and 17-year-olds, will also increase County expenses. The State will reimburse the County for those additional expenses but only if the County keeps its property tax levy below the tax cap level of 2 percent per year.

- The County is also facing substantial infrastructure expenses, particularly for bridges and culverts.

The Town of Le Roy's anticipated share of sales tax revenue for 2019 is $722,000, or nearly 51 percent of the town's total revenue.

Elected representatives, including county officials, are expected to discuss the sales tax issue at the monthly Genesee Association of Municipalities (GAM) meeting Sept. 20 at 7 p.m. at County Building #2 on West Main Street Road in Batavia.