The state provides a tax exemption to industrial solar projects and until recently county officials didn't realize they had any say on whether to allow these exemptions.

Typically, the projects are built on farmland and the county can continue to tax the property at the established assessed value, but if the solar farm increases the assessed value of the land -- typically 10 acres -- then the property is exempt from taxes on the amount of the assessment increase.

The options for the county are to opt-out, through a local law, on the tax exemption, or establish a PILOT on projects on a case-by-case basis.

PILOT stands for Payment In Lieu of Taxes, and typically a PILOT ramps up the amount of payments made as a percentage of the increase in assessed value over a period of years.

Under state law, the solar farm properties are exempt from taxes on the increase in assessed value for 15 years for county, town and school taxes.

"I think everybody should be able to do what they want with their land but the real issue is the state telling us what we can’t tax them on," said Legislator Andrew Young during a discussion of the issue during yesterday's Ways and Means Committee meeting. "Because of that reason, I think we should at least do something to maintain a little control."

By consent, the committee agreed to have County Attorney Kevin Earl draft a local law to have the county opt-out of the exemption.

There are three solar projects under construction and all three were started before the county learned it had the choice to opt-out of the exemption or establish a PILOT.

The issue came to the county's attention because the builders of a fourth project on Pearl Street Road came to the county and volunteered to pay a PILOT.

That caused Legislator John Deleo to wonder why the company would volunteer for to make PILOT payments.

"I think they know counties are going to start taxing everybody, so they’re going to get ahead of it and don’t want to get stuck with the full no-exemption later on," suggested County Highway Superintendent Tim Hens.

It's unclear if the county can go back to the projects already under construction and void the exemption or require a PILOT.

The company with the project on Pearl Street Road told county officials that not only did they anticipate building other projects in the county, but that officials should expect more solar companies seeking farmland for solar farms locally.

The developers typically lease the farmland at $6,000 a year for 15 years.

Legislator Marianne Clattenburg said that should be a big concern to legislators.

"My fear is we have pretty reasonable land costs here and that these are going to pop up everywhere and it’s open season because Geneses County hasn’t really established any kind of policy regarding (solar farms)," Clattenburg said. "If other counties do start doing it, then we’re going to get the brunt of it all."

Legislator Shelly Stein noted that two of the three solar farms going in are on "wet land," less than prime farmland, and that she's aware of four projects proposed in Le Roy that were turned down by National Grid because the nearest power station is over capacity already.

Hens said the typical project is 2.5 megawatts and costs $5 million to build.

How they should be assessed has yet to be established.

If the Pearl Street Road project goes forward and PILOT is instituted, it won't produce any revenue for the county before 2020, maybe in 2019.

Kevin Andrews, deputy county treasurer, said the PILOT payments won't help the county increase its overall tax levy.

"There’s no overall revenue benefit to the county at that point," Andrews said. "It’s more of a shift so the solar companies are picking up a little extra versus the rest of the taxpayers."

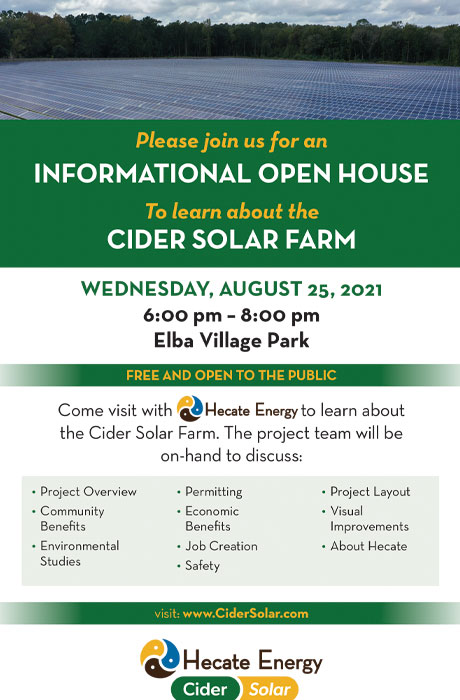

Photo: Taken today of a solar project under construction off State Street Road near West Saile Drive.