Here's what residents living in flood-prone areas in Batavia need to know: The city can help lower the cost of flood insurance, but nothing can stop it from going up.

Assistant City Manager Gretchen DiFante, hired primarily to help the city get a comprehensive flood insurance program going, said the cap on annual insurance-rate increases is 18 percent (it used to be 25 percent). If the city's program works as intended, the best result would be 15-percent lower premiums for local homeowners.

Rates will rise, she explained after the Monday City Council meeting, until an insurance company reaches 100-percent coverage for an individual property according to its actuarial tables.

"Not everybody is going to go up and not everybody will go up at the same rate," DiFante told the council.

This is an important issue, she said, because the rising cost of flood insurance will make it harder and harder for property owners to sell their homes. That leads to more sub-par rentals, more abandoned houses, higher crime and less tax money for local schools.

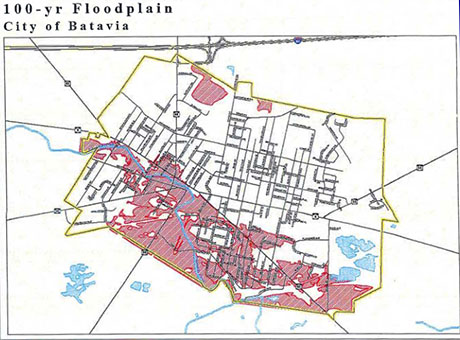

"When you look at the map, you have to realize, this is more than a thousand homeowners who are not going to be able to sell their homes if something doesn't change," DiFante said.

"I don't care where you live, it ought to be a concern," she added. "If it's not, it should be."

DiFante's job is to work with FEMA to get the city into community rating system (CRS) of the National Flood Insurance Program (NFIP).

Cities accepted into the program get class ratings. A Class 7 community gets a 5-percent reduction in flood insurance rates, and a Class 9 community gets 15 percent.

There are two main components to the ratings:

- Reduce a community's flood exposure through mitigation activities;

- Obtain individual flood insurance reductions for residents in flood map areas.

But the process is far more complex than those two simple points, DiFante said.

"It is a daunting process, which is why I think there's only 27 communities in New York who have taken this on," DiFante said. "There's so much information you have to put together and in such a specific way you have to do it. Then every time you've got different reps from ISO who come in, everybody's kind of got their own way interpreting what you've done."

On a broad scale, the city will need to review zoning and building codes and make adjustments to mitigating flooding issues.

On an individual homeowner basis, the city can provide guidance and perhaps secure grants for elevation certificates that could lift some homes out of the flood map, or improve an individual property's rating.

The elevation certificate process can also provide property owners with guidance on improving their property from a flood exposure perspective.

It will be at least 16 months before the city realizes any benefits from its flood insurance efforts.

Red areas are floodplain.

It appears to me that this is

It appears to me that this is an attempt of the Federal Government to intrude on the right of an individual to live any where he or she chooses. A subtle attempt to force individuals to live in areas they deem safe. From what I hear, the rates for this coverage is outrageous.

It appears to me that this

It appears to me that this new asst manager has no control over increasing flood insurance rates and that those rates will keep on rising..Batavia will not get those flood zones redone by FEMA any time soon.. Just another job that the city didn't need..