Trade Wars

This is part seven of an eight-part series on trade and how changes in policy might affect the local economy.

If the Trump Administration upsets the trade relationship with Mexico, our southern neighbors are already threatening retaliation with tariffs of their own on corn, and turning to South America for one of the country's food staples in what is already dubbed a "tortilla war."

Craig Yunker, CEO of CY Farms, said such a move, especially at a time of a strong U.S. dollar, would certainly hurt local farmers.

"The GLOW region's economy is highly dependent on agriculture," Yunker said. "Agriculture is highly dependent on exports. A trade war coming out of anti-trade comments and tweets will put our regional economy at risk."

Rep. Chris Collins said he isn't worried about a trade war. If there is one, he said, it would be short-lived because other countries need us more than we need them.

"No one wants to use the word war in any sentence," Collins said. "What I would remind people is that if there is a war, we'll win the war."

The calculation Collins looks at, he said, is "four and 25," meaning the United State has 4 percent of the world's population and accounts for 25 percent of the world's economy (Collins and I had some discussion about this number. I told him it was 15.8 percent, but that turns out to be a number adjusted for something called purchasing power parity, which adjusts for exchange rates; the current nominal rate is just over 25 percent.

While on the campaign trail, Trump spoke frequently about the $346 billion trade deficit with China; there are some factors that raw number leaves out.

First, much of the $115 billion the U.S. exports to China goes over as raw goods and comes back as more expensive, manufactured goods.

Second, the U.S. GDP per person is $51,638. That is higher than any other major nation and much higher than China, at $6,497, (and much higher than our other major global rival, Russia, at $11,615. That means U.S. consumers have more money to spend on products, meaning more demand for products. Of course, it also means the cost of labor in China is much lower than in the United States.

While the GDP per person is low in China, it has grown substantially over the past two decades. The number of people living below the poverty line in China has fallen from 750 million in 1990 to less than two million today. Free trade has been good for China, which is probably why the communist president Xi Jinping has become a champion of open markets.

“Pursuing protectionism is like locking oneself in a dark room,” Jinping said. “Wind and rain may be kept outside, but so is light and air.”

These are among the reasons, Collins argues, that China needs the United States, which makes a trade war unlikely.

"What happens if China loses access to U.S. consumers?" Collins said. "It's going to be anarchy over there. On the agricultural front, I would hate to see that happen, but that also begs the question of supply and demand. We're a big supplier. What's going to happen to the price of corn if all that corn comes out of the market? They're going to start raising prices."

What's known of Trump's trade plans is that he plans to focus heavily on deficits with each trading partner even though trade deals usually lower barriers with trade partners more than they lower our own already low duties. There's also some concern that Trump might want to pull the nation out of the WTO, a move many economists believe will only weaken the United States as the rest of the world moves on with free trade without us.

While Jim Campbell, CEO of Chapin, supports new trade deals that help U.S. manufacturing, he doesn't think the United States should turn to a more protectionist stance.

"The one thing we can all agree on is protectionism doesn't work," Campbell said.

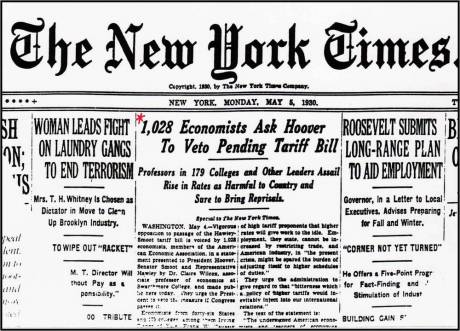

It didn't work for America, or the world, during the Great Depression, when Congress passed the Smoot-Hawley Smoot–Hawley Tariff Act, a contributing factor to making a bad recession worse.

"We still need some free trade," Campbell said. "We need fair trade."

Fair trade: Most business leaders we spoke to for this series, even most of the strong free-trade advocates, have some complaint about how seemingly unfair trade practices of other countries hurt their businesses. Dean Norton, former president of the NY State Farm Bureau, acknowledged the provincial dairy protections of Canada. Local farmer Maureen Torrey noted there are some crops her farm ships to Canada only rarely.

John DeLuca, sales manager for Liberty Pumps, said he just returned from Indonesia, which charges a duty on U.S.-manufactured pumps entering their country, but there is no duty on pumps entering the United States.

Jeff Glajch, VP of finance at Graham Manufacturing, thinks addressing these kinds of issues will bolster U.S. manufacturing, and even bring more manufacturing back to Batavia, so anything the Trump Administration can do to "level the playing field" would be good for America.

"If there’s a trade policy that favors U.S. manufacturing that is a positive to us," Glajch said.

What we don't know yet from the Trump Administration is what fair trade looks like and how we move from where we are now to where President Donald Trump thinks we should be.

GRAPHIC: Reproduction of the front page of The New York Times from 1930 carrying the warning of economists that the Smoot-Hawley Tariffs would start trade wars.

Previously:

The primary point that all

The primary point that all the positive sounding statistics and rhetoric in this segment ignores is the US Debt. How can Yunker or anyone for that matter say the US$ is "strong" when the US is $20 Trillion in Debt to the rest of the world's primary economies? This report flashes stats like "the U.S. GDP per person is $51,638... that means U.S. consumers have more money to spend on products", BUT it ignores the fact we borrow to consume. It’s all debt based! For years the US has been sustained by money borrowed from other economies - mainly China, and burrowed from the Federal Reserve facilitated by the Fed's continual printing of new money, which increases the amount of money in circulation and thus causes the US$ to be worth less... NOT stronger. Interesting times are ahead.

The U.S. dollar is worth 6.89

The U.S. dollar is worth 6.89 Chinese Yuan, up from 6.0 in 2014, so it's been gaining strength even as debt has climbed.

The U.S. has continued to increase the money supply at a steady rate since the 1970s. The monetary policy is to avoid deflation and try to manage inflation.

There is no correlation between increased money supply and increased foreign trade deficit and strength of the dollar.

The U.S. debt at $20 trillion, you seem to be referring to public debt. The public debt has nothing to do with trade deficits, other than trade deficits give foreign nations the cash flow (and the need) to buy our debt. That said, foreign governments own only about 1/4 of the U.S. debt. Most of it is held by U.S. entities, including social security and many retirement funds.

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Private debt, which you also seem to refer to, is tied to trade deficits. We do tend to borrow to buy, and debt helps finance that, but U.S. private debt to GDP has been in dramatic decline since the recession.

https://fred.stlouisfed.org/series/HDTGPDUSQ163N

Private savings is more highly correlated to trade deficits. Compare the U.S. to China.

http://data.worldbank.org/indicator/NY.GNS.ICTR.ZS?locations=US

http://data.worldbank.org/indicator/NY.GNS.ICTR.ZS?locations=CN

U.S. citizens tend to save less than Chinese because we tie up a lot of our wealth in our homes and rely more on Social Security for our old age. Those options are not available to the same extent to Chinese, who must save more for retirement.

We borrow to consume, often at a higher rate than our income, or that GDP per capita. We still have a higher standard of living than any of the countries, including Germany, that we have a trade deficit with. Our personal debt is mostly held by U.S. banks, not the Chinese or Germans.

Trade deficits do play a roll in attracting investment in U.S. Much of the stock price run ups of the past few years have been driven by foreign investors. That pumps more money into the U.S. economy, money that wouldn't be there without foreign companies needing someplace to invest their U.S. dollars. It's also a testament to how stable and secure the U.S. is considered for investors. They also buy real estate here and invest in our startup companies, helping to grow our economy.

BTW: The Chinese have their

BTW: The Chinese have their own debt woes. http://www.economist.com/news/leaders/21625785-its-debt-will-not-drag-d…

For all the positives you

For all the positives you offer and the accompanying links, there are just as many financial experts [not me] who would strongly disagree. Anyone who managed their household budget in the manner that the US has managed its, would have ended up in debtors prison.

Like I said, interesting times are ahead.

https://dailyreckoning.com/markets-set-fall/

It's not hard to predict

It's not hard to predict another market downturn. The DOW and S&P are at record high levels.

Who knows what might trigger it. Only a few wonky savants saw the 2008 crisis coming.

Household budgets and the finances of the world's largest economy have absolutely nothing in common.

Debt is a concern because it does suck some money out of the economy, slowing growth, but the national economy can withstand a lot of debt.

Trump, of course, intends to add massive amounts of debt in his spending priorities.

Keynesian economists would predict that massive infrastructure spending at a time of a tightening labor market would spur inflation. Inflation would help reduce the debt (by making the pre-inflation dollars of the debt less valuable), but inflation can get out of control and do great damage to a great many people. Tariffs could also spur inflation.

And most of the links I supplied weren't to experts, just data.

Brian, this may interest you.

Brian, this may interest you.

http://blogs.wsj.com/economics/2017/03/31/americans-owe-other-countries…